The downward trend continues in Q3 as evidenced in the decline in return on sales (ROS). The average net profit of $1.7M is down from $2.5M, a 31% drop YOY. The ROS of 4.0% heading back closer to the pre-pandemic value, a drop of 2.1 percentage point from 6.1% a year ago. One positive note is that the New Vehicle units continue to increase YOY, however, dealers are not able to retain the once lucrative gross profit.

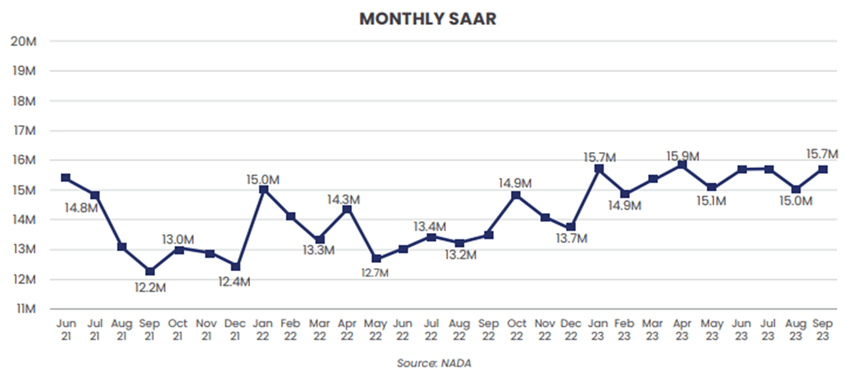

New Vehicle sales remain strong at 513 units/per dealer, compared to 463 units/ per dealer last year. The gross profit per unit declined the most this quarter at 54% year over year, from $3,271 to $1,511 per unit.

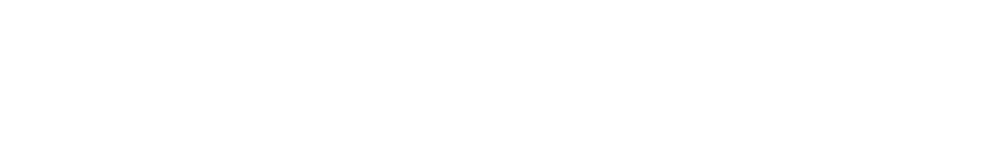

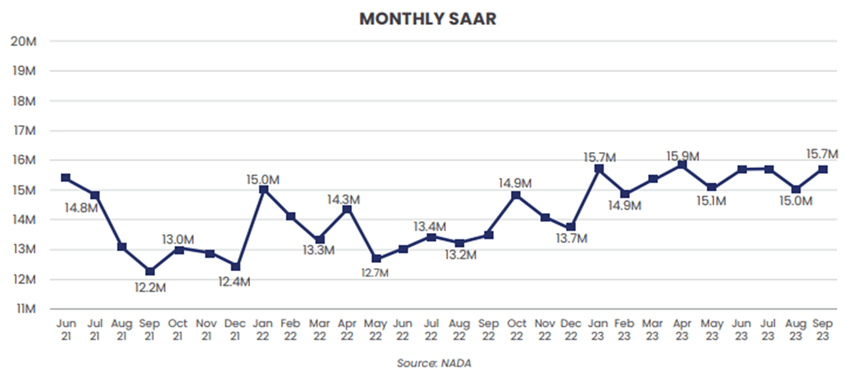

According to NADA, new light vehicle sales increased to a SAAR of 15.7M in September, up 14.4% compared to September of last year. NADA believes that this estimate would have been even higher if not for the UAW strikes impacting the Detroit 3. The challenge for dealers is to meet this increasing demand while not taking too many vehicles into inventory, a challenge that has not existed for the past three years.

The increase in sales is not enough for dealers to maintain a strong Operating Profit % Sales. This quarter the operating profit declined 2.4 percentage points, down from 3.1% to 0.7%. The number of loss dealers grew 6.7 percentage points, from 2.0% to 8.7%.

New Vehicles

New Retail Vehicles for Sept YTD increased 11% YOY from 463 to 513 units/dealer per month. Average New Vehicle Sales price remains flat at $45K. Conversely, the New Vehicle Gross Profit per unit declined 37% YOY from an average of $5,280 to $3,335 per unit. The Days Supply climbed up to 44 days compared to 27 days the prior year.

Used Vehicles

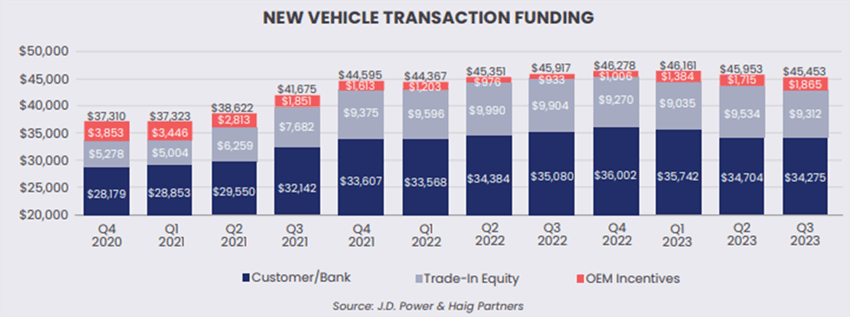

Used Vehicle sales also continue to show an increase in YOY from 516 to 539 units or a 4% improvement. The Average Used Retail sales price continues to decline for 10 consecutive quarters from $30,124/unit to $27,702/unit or 8% down YOY. However, it shows almost no change from Q2 2023. The Average Used Retail sales gross profit shows the same decline from the previous quarter at 22% (down from $2,577/unit to $2,077/unit.

Fixed Operations

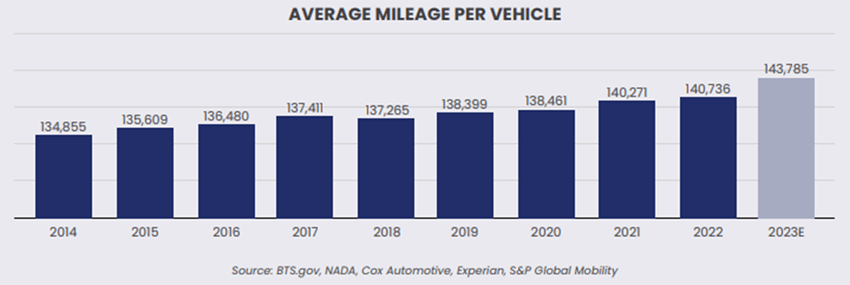

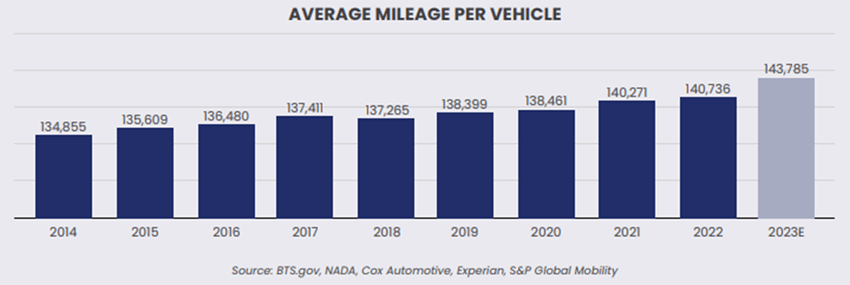

The fixed operations department continues to be a bright spot for dealerships. According to NADA, Fixed Operations gross profit continues to climb at an impressive rate, rising 9% from YTD Q3’22 to YTD Q3’23. The average vehicle on the road hit 12.5 years old this fall – the highest age on record – and these vehicles have higher mileage than ever before. Additionally, consumers that want to purchase new vehicles have been met with record-high new vehicle prices and high interest rates, making new vehicles unaffordable for many today. These consumers are maintaining their current vehicles rather than purchasing expensive new or used vehicles today.

For the OEMs in our client base, Total Service ROs increased slightly at 1%, however, the Total Service Sales per RO and Gross Profit per RO increased 9% and 11% respectively YOY. The Gross Profit per RO for CP Sales and Warranty increased 13% and 10% respectively.

Total Parts Sales per RO increased 3% YOY and Gross Profit per RO increased 5% YOY. Parts Inventory decreased 3% from $416K to $404K.

Service Absorption shows a strong growth every quarter and in Q3, the increase is 4.4 percentage points from 62.5% to 66.9%.

Trends to Monitor

Below are the continuing trends as agreed by the analysts in automotive retail market:

- Inflation is declining, but Auto Products remain expensive

- GDP Growth more than doubles Quarter-over-Quarter in Q3

- FED pauses rate hikes, but interest rates remain sky-high

- The Labor market outperforms expectations

The slowing down in gross profit is evidenced in the vehicle sales on Q3 2023. The vehicle demand seems to remain strong, however, customers are not willing to pay more than the market price. As inventory becomes more available, dealers have to be more competitive, and sacrifice profit a bit more. Dealers will have to continue to find ways to attract customers and their willingness to pay certain prices.

Note: *The data presented in this article is a composite of information collected from our clients, including Audi, Hyundai, Kia, Volkswagen, and Volvo. The gathered data has been meticulously analyzed to provide accurate and comprehensive insights for the purpose of this article.